Energy efficient homes offer first-time buyers significant financial and environmental benefits, including up to 30% savings on utility bills. Key features include improved insulation, smart thermostats, and innovative building techniques. Buyers should research local incentives, consult green financing lenders, and consider certifications like ENERGY STAR or LEED for informed choices. This approach aligns with government sustainability goals and secures long-term financial stability while promoting a greener future.

In today’s world, purchasing an energy efficient home has become a strategic decision for first-time buyers seeking both financial savings and environmental stewardship. As living expenses rise, homeowners are increasingly looking to reduce utility costs while also contributing to a sustainable future. Energy efficient homes offer a compelling solution, allowing buyers to enjoy lower energy bills, increased property value, and reduced carbon footprints. However, navigating the market for these homes can be challenging without proper guidance. This article provides an authoritative analysis of actionable strategies for first-time buyers interested in investing in energy efficient homes, equipping them with the knowledge to make informed decisions in this burgeoning market.

Understanding Energy Efficient Homes: Basics Explained

Energy efficient homes have emerged as a crucial consideration for first-time buyers navigating the real estate market. Understanding the basics of these homes is essential for borrowers looking to make informed decisions about their future living spaces. An energy efficient home, at its core, is designed to optimize resource usage while minimizing environmental impact. This often translates into reduced energy bills for homeowners over time. Key features include improved insulation, high-efficiency appliances, and smart thermostats that learn and adapt to occupants’ routines.

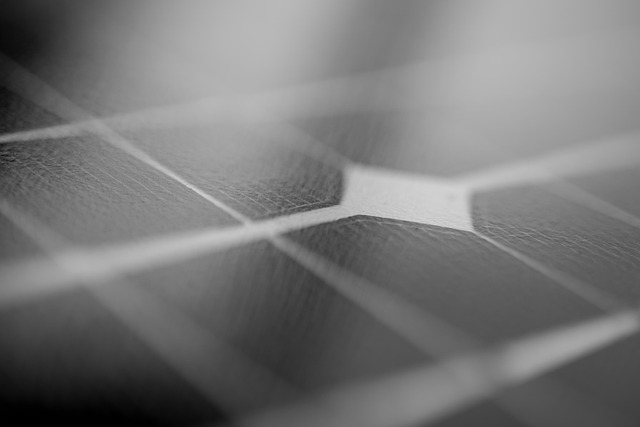

These homes employ innovative building techniques such as better window placement and advanced air sealing to prevent heat loss or gain, thereby reducing the need for artificial heating and cooling. Incorporating renewable energy sources like solar panels can further enhance efficiency, allowing homeowners to generate their own clean electricity. According to recent data, homes with energy-efficient features can save occupants up to 30% on utility bills annually, making them a financially sensible choice for borrowers looking to stabilize their living expenses.

For first-time buyers, incorporating these considerations into your search requires a bit of research and guidance. Start by educating yourself about local building codes and incentives that promote energy efficiency. Many regions offer tax credits or rebates for installing specific energy-saving technologies, making these homes more affordable. Consult with mortgage lenders who specialize in green financing to understand how energy efficient home features can impact borrower requirements, such as down payment amounts or interest rates. This proactive approach will ensure a smoother purchasing process and help you secure your dream home while promoting sustainable living.

Benefits for First-Time Buyers: Saving Money & Environment

For first-time buyers entering the housing market, investing in energy efficient homes presents a compelling blend of financial savings and environmental benefits. These homes, designed with sustainability in mind, offer long-term financial stability through reduced utility bills. According to the U.S. Department of Energy, an energy-efficient home can save occupants up to 30% on their heating and cooling costs compared to traditional homes. Over time, these savings can significantly contribute to a borrower’s overall financial health, with energy efficient homes often appealing to lenders due to their lower operational costs. This not only benefits the homeowner but also demonstrates responsible stewardship of resources—a growing consideration for environmentally conscious buyers and lenders alike.

The environmental impact of energy efficient homes is profound. By reducing energy consumption, these residences lower a household’s carbon footprint, contributing to global efforts in combating climate change. For first-time buyers, this translates into the opportunity to live more sustainably from day one in their new home. Moreover, many governments offer incentives for purchasing eco-friendly properties, further incentivizing responsible buying choices and creating a positive feedback loop that promotes broader adoption of energy efficient practices within the housing sector.

To capitalize on these advantages, first-time buyers should actively seek out homes with recognized energy efficiency certifications such as ENERGY STAR or LEED (Leadership in Energy and Environmental Design). These certifications provide transparency about a property’s energy performance and can serve as a guide for borrowers when evaluating potential purchases. Lenders, too, are increasingly incorporating energy efficient home features into their loan requirements (1-3 times higher than conventional mortgages), recognizing the long-term stability and environmental benefits these homes offer. By aligning with these trends, both buyers and lenders can participate in driving a more sustainable future while securing sound financial investments.

Getting Started: Key Steps to Purchase an Energy Efficient Home

For first-time homebuyers interested in making a sustainable and cost-effective choice, purchasing an energy-efficient home is an excellent decision. This approach not only reduces environmental impact but also offers long-term financial savings. Getting started with this process involves understanding key considerations and taking practical steps to identify and secure the right property. One of the primary aspects to focus on is the borrower’s requirements, ensuring that financing options align with the specific needs of energy-efficient home purchases. According to recent studies, many lenders now offer specialized programs tailored for such homes, with lower interest rates and flexible terms.

The initial step involves assessing personal financial health and setting a budget. Energy efficient homes often come with higher upfront costs but can be recouped through reduced utility bills over time. First-time buyers should analyze their current finances, including savings, income stability, and debt levels, to determine a comfortable price range for their energy-efficient home search. It’s crucial to consult with lenders who understand these specialized purchases; they can guide borrowers on the necessary down payment amounts and offer insights into potential tax incentives and rebates available for such homes. For instance, many regions provide rebates or credits for installing solar panels or high-efficiency appliances, significantly offsetting initial costs.

Researching local real estate markets is vital to understanding energy efficient homes’ value proposition. Buyers can explore neighborhoods with a history of promoting sustainability, as these often feature a mix of new and existing energy-efficient homes. Property listings should be scrutinized for relevant certifications and energy ratings, which indicate the home’s efficiency level. Additionally, attending local open houses or joining community forums allows buyers to gain firsthand insights from current residents about their experiences living in energy-efficient homes. This knowledge can dispel myths and emphasize the practical benefits of such properties, further encouraging informed purchasing decisions.